Introduction

At some point, you are going to realize that there just might be more to life than your career. Or you might just get tired of working in the insanity that is IT. Either way, sooner or later you are going to start thinking about your retirement.

Will you be able to retire early on the stock options you cashed out just before the big pop, or did you have to start over? With your current investments, how long do you have before you can retire? Would a simple change to your investment strategy shave years off your eventual retirement date? Inquiring minds want to know!

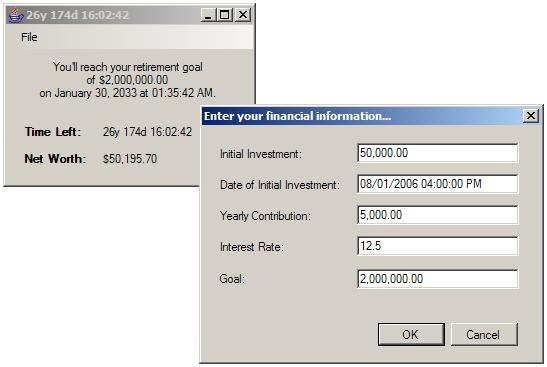

To answer these questions for myself, I developed this deceptively simple yet infinitely entertaining application called "Retirement Countdown." Retirement Countdown takes some basic information from you and uses it to calculate your time to retirement and your current approximate net worth (if the market cooperates). The display is continuously updated so you can see the seconds ticking off and the pennies adding on.

I have found it immensely therapeutic after a long meaningless meeting to stare at Retirement Countdown for a minute or so to remind myself what I'm working toward. It also provides a great deal of incentive for me to keep investing in my 401K plan and stay on top of my investments.

Hey, don't take my word for it. Download the code and try it for yourself!

Background

The technical part of this application is not worth mentioning. What's interesting to me is the mathematics of compound interest. You invest a little and you wait. If you wait long enough, your little investment will turn into a fortune. Theoretically speaking, it is the mathematics of exponentiation. Practically speaking, how much do I need to save, and how long do I have to wait?

There are basically two considerations we need to make. First, you probably already have some investments. We'll call that your "nest-egg." Second, you probably want to make additional contributions to your investments periodically.

The first key formula tells you how much you'll make on your nest-egg if you don't make any additional contributions.

Vf = S(1 + i)n

| Vf | - The future value of the investment. |

| S | - The initial lump-sum amount. |

| i | - The interest rate your investment earns per period (ex. 12.5% is 0.125) |

| n | - The number of periods. |

The second key formula tells you how much you'll make if you start with nothing and make regular contributions into your investment account.

| P | - The contribution (payment) you make each period. |

By combining the formulas, we get a single, unified formula that tells us how much you'd make if you started out with a lump sum and also made regular contributions. This formula is used in the application to estimate your current net worth.

| Vf = S(1 + i)n + | P(1 + i)n |

| i |

Now if we solve the previous formula for n, we can calculate the number of periods (years) until we reach our goal (retirement). The application uses this formula to estimate your retirement date and to calculate the time left until you can retire. I'll leave it as an exercise for the student to derive this formula from the one above.

| n = log1+i( | P + iVf | )nlog=i+1 |

| P + iS |

Using Retirement Countdown

It's pretty easy to use Retirement Countdown. You just run it, enter your assumptions, and keep it minimized on the desktop. If you'd like, you can update your assumptions periodically - perhaps once a year.

The source package contains a compiled version of Retirement Countdown as well as the full source code and all associated project files. At a minimum, you will need to install the Microsoft.NET 2.0 Runtime package to run this application. The project requires Visual Studio 2005 or the Microsoft.NET 2.0 SDK if you want to compile the code yourself.

Points of Interest

Why stop at your own retirement account? It might be fun to pretend to be someone else. How about the champion of Visual Basic and also the richest man in the world, Bill Gates? A recent Forbes article listed Mr. Gates net worth at $40.7 billion. Pick a goal (maybe $100,000,000) and a growth rate (let's say 8%). Now sit back and relax as you watch the Gates fortune grow by more than $100 per second!

All kidding aside, God bless you, Mr. Gates, for the wonderful things you are doing through the Gates Foundation. Please don't ever stop doing what you are doing. And thanks for keeping the faith with Visual Basic all these years. With the 2005 release, I think it has finally shown its true, remarkable potential!

This member has not yet provided a Biography. Assume it's interesting and varied, and probably something to do with programming.

General

General  News

News  Suggestion

Suggestion  Question

Question  Bug

Bug  Answer

Answer  Joke

Joke  Praise

Praise  Rant

Rant  Admin

Admin